Market Overview 2025-2033

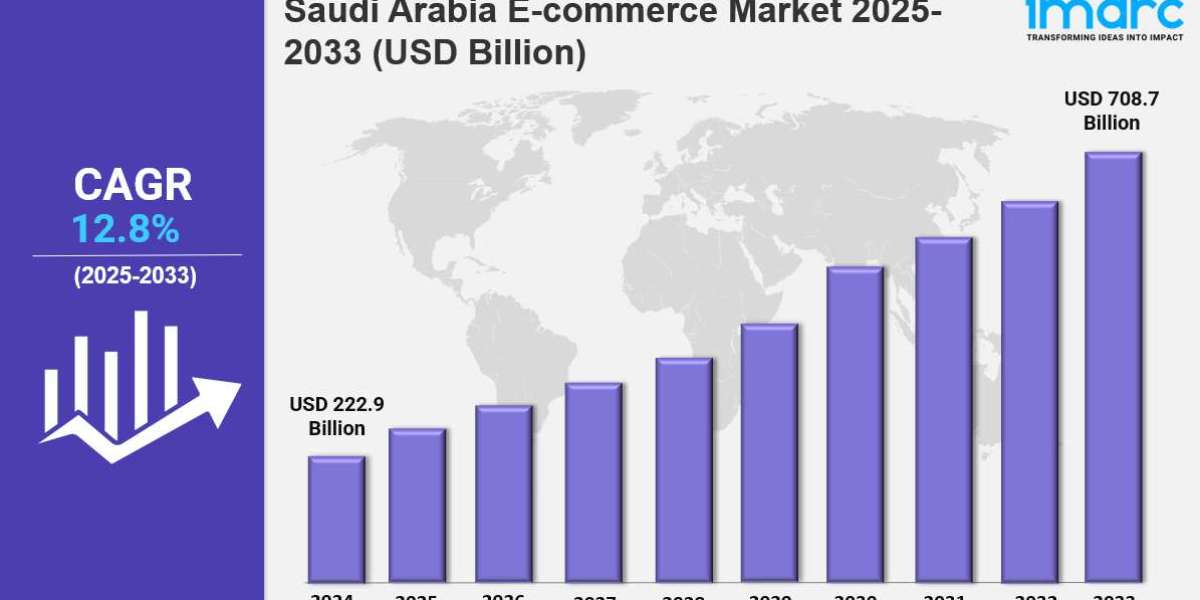

Saudi Arabia E-commerce market size reached USD 222.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 708.7 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. The market is growing rapidly due to increasing internet penetration, digital payment adoption, and shifting consumer preferences. Government initiatives, technological advancements, and expanding product categories are key factors driving industry expansion.

Key Market Highlights:

✔️ Rapid market growth driven by increasing internet penetration and digital payment adoption

✔️ Rising demand for fashion, electronics, and grocery shopping through online platforms

✔️ Expanding government initiatives supporting digital economy and logistics infrastructure development

Request for a sample copy of the report: https://www.imarcgroup.com/saudi-arabia-e-commerce-market/requestsample

Saudi Arabia E-Commerce Market Trends and Drivers:

The Saudi Arabia e-commerce market is experiencing substantial growth, driven by government initiatives, improved digital infrastructure, and a predominantly young population with high internet and smartphone usage. As part of Vision 2030, the Kingdom is emphasizing economic diversification, with digital commerce playing a key role in non-oil sector development. Internet penetration is expected to surpass 90% by the end of 2024, creating favorable conditions for the expansion of online retail.

Key factors such as convenience, product variety, and competitive pricing are contributing to increased consumer interest in online shopping. Social media platforms including Instagram, TikTok, and Snapchat are significantly influencing purchasing behavior by acting as channels for product discovery and digital marketing. This trend is supporting the continued growth of e-commerce activity in the country.

The COVID-19 pandemic accelerated the shift from in-store to online shopping, a change that has since become embedded in consumer habits. Categories such as electronics, fashion, and personal care now see a substantial portion of sales conducted through digital platforms. Projections for 2024 suggest that e-commerce will account for a growing share of overall retail sales in Saudi Arabia.

Market competition is leading businesses—both local and international—to improve their offerings through more personalized shopping experiences, loyalty programs, and streamlined customer service. Developments in logistics, including last-mile delivery solutions and automated warehouses, are enhancing supply chain efficiency. Additionally, the increasing use of digital payment methods, such as mobile wallets and contactless transactions, is contributing to the shift toward a cashless retail environment.

Social commerce continues to influence consumer behavior, with features like in-app purchases, personalized product suggestions, and flexible payment options such as buy-now-pay-later (BNPL) becoming more common. These developments align with national strategies that encourage digital innovation across industries.

The outlook for Saudi Arabia’s e-commerce sector remains strong. Ongoing investment in infrastructure, regulatory support, and a growing base of online shoppers are expected to drive further market expansion. Trends indicate that the sector will play an increasingly important role in the country's retail economy and broader efforts toward economic modernization.

Saudi Arabia E-Commerce Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Saudi Arabia e-commerce market report. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Type:

B2C E-commerce

B2B E-commerce

Breakup by Region:

Northern and Central Region

Western Region

Eastern Region

Southern Region

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145