Market Overview

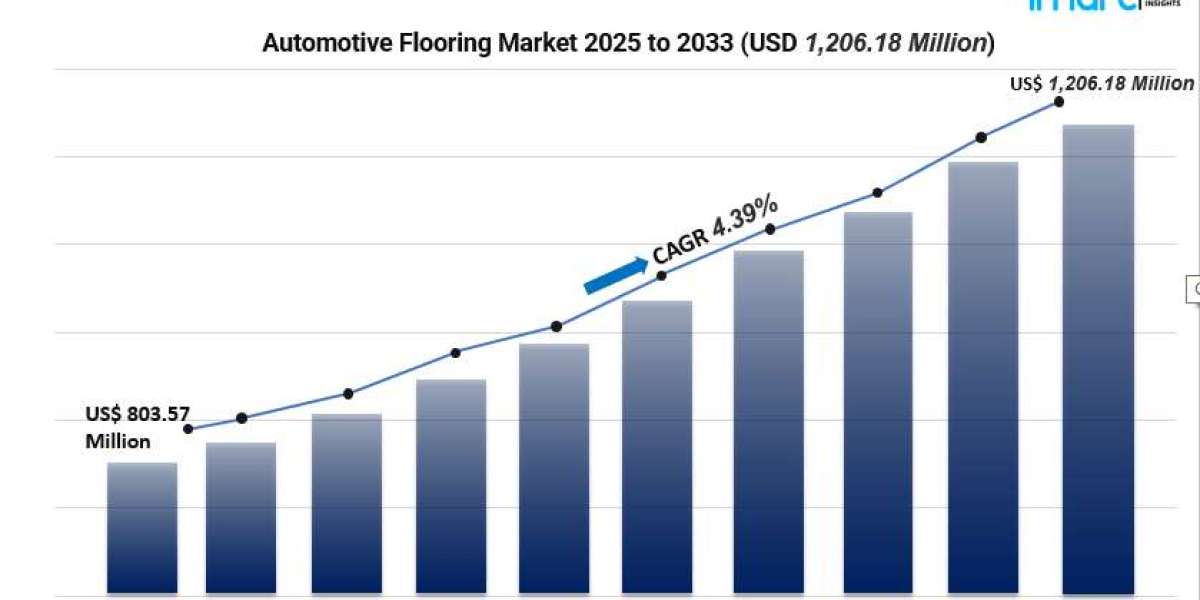

The global automotive flooring market was valued at USD 803.57 million in 2024 and is projected to grow to USD 1,206.18 million by 2033, at a CAGR of 4.39%. Increasing vehicle production, rising demand for comfortable and hygienic interiors, safety-driven material innovations, and the shift toward EVs promoting lightweight, eco-friendly flooring solutions are fueling strong growth.

Study Assumption Years

- BASE YEAR: 2024

- HISTORICAL YEAR: 2019–2024

- FORECAST YEAR: 2025–2033

Automotive Flooring Market Key Takeaways

- Asia‑Pacific leads, capturing over 53.5% of the market in 2024.

- Market size of USD 803.57 million in 2024 will expand to USD 1,206.18 million by 2033, at a 4.39% CAGR.

- Segment-wise growth spans products (carpets, mats), materials (polyurethane, polypropylene, nylon, rubber, others), vehicle types (passenger, LCV, HCV), and channels (OEM, aftermarket).

- Rising EV and luxury vehicle production is driving demand for lightweight, durable, easy-to-clean flooring.

- Strict safety and sustainability regulations are accelerating adoption of non-toxic, recyclable flooring solutions.

Market Growth Factors

1. Rising Vehicle Production & Interior Comfort

The recent boom in vehicle manufacturing around the globe—especially in the Asia Pacific region—has led to a significant rise in the demand for automotive flooring. As original equipment manufacturers (OEMs) pay closer attention to what consumers want, the interiors of vehicles are becoming more sophisticated. Nowadays, flooring materials are designed to prioritize tactile comfort, insulation, noise reduction, and easy cleaning. With an uptick in the production of both passenger cars and commercial vehicles, manufacturers are pouring resources into developing carpets and mats made from cutting-edge polymers and composites. The growth of electric vehicles (EVs) is also driving the need for lightweight materials that can help maximize range, while trends like urbanization and ride-sharing are increasing the demand for durable, low-maintenance flooring options. These changing requirements are fueling the market's growth, projected to reach USD 803.57 million by 2024.

2. Technological Innovation & Material Advancement

Flooring manufacturers are stepping up their game by embracing innovation—creating eco-friendly composites, recyclable materials, and next-generation options like blends of polyurethane and polypropylene. These materials not only offer better thermal, mechanical, and chemical resistance but also help reduce weight. Advances in sound-absorbing layered carpets are further enhancing the overall refinement of vehicles. The transition to EVs has intensified the focus on optimizing materials, pushing research and development for sustainable and long-lasting flooring solutions. Both OEMs and aftermarket companies are introducing designs that feature microfoam layers, water resistance, and antimicrobial treatments. A diverse range of materials, including nylon and rubber, is being utilized to meet performance needs across different vehicle segments, ensuring that they meet both comfort and regulatory standards.

3. Regulatory Standards & Sustainability

The way we choose flooring is increasingly shaped by global safety and environmental regulations. Manufacturers are stepping up by using non-toxic, recyclable, and low-VOC materials to comply with air-quality standards and recycling requirements. Policies aimed at reducing vehicle emissions and indoor pollution are pushing the adoption of sustainable flooring, especially in the Asia Pacific region, where manufacturing costs are lower. The rise of electric vehicles (EVs) is also in sync with eco-friendly supply chains, resulting in materials that are renewable and can be recycled in a closed loop. Flooring suppliers are now more in tune with automakers’ environmental, social, and governance (ESG) goals, incorporating biodegradable fibers and soy-based polyurethane to satisfy consumer preferences and future regulations.

Request for a sample copy of this report: https://www.imarcgroup.com/automotive-flooring-market/requestsample

Market Segmentation

By Product Segment:

- Carpets: Soft textile coverings offering comfort, insulation, and noise reduction.

- Mats: Removable rubber or polymer mats focused on ease of maintenance and cleaning.

By Material Segment:

- Polyurethane: Lightweight, durable, and resistant; commonly used in advanced flooring.

- Polypropylene: Cost-effective material with good chemical resistance.

- Nylon: Durable nylon carpets, offering abrasion and stain resistance.

- Rubber: Heavy-duty mats ideal for durability, water resistance, and ease of cleaning.

- Others: Includes vinyl, rayon, and alternative composites used for niche applications.

By Vehicle Type Segment:

- Passenger Cars: Major end‑user of automotive flooring for comfort and customization.

- Light Commercial Vehicles: Flooring emphasizes durability and easy cleaning.

- Heavy Commercial Vehicles: Rugged flooring for high-usage commercial transport.

By Distribution Channel:

- OEM: Original installations within new vehicles.

- Aftermarket: Replacement or custom flooring sold post-sale.

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

In 2024, Asia Pacific is set to lead the market with a significant 53.5% share. The region's robust automotive production, cost-effective manufacturing, increasing EV adoption, and stringent safety and environmental regulations are all fueling the demand for lightweight, sustainable flooring options. The rapid pace of urbanization and the rise of middle-class vehicle ownership are enhancing both original equipment manufacturer (OEM) and aftermarket segments.

Recent Developments & News

According to IMARC’s report, there’s a surge in innovation surrounding eco-friendly materials and designs in automotive flooring. Manufacturers are rolling out sustainable carpets and mats made from recycled fibers and biodegradable materials, aligning with the global shift towards green mobility. Moreover, flooring suppliers are upping their game in aesthetic customization, offering a variety of textures, patterns, and easy-to-clean coatings designed for premium and EV markets. These advancements showcase a growing synergy between consumer preferences, regulatory demands, and manufacturing innovation.

Key Players

- 3M Company

- Auria Solutions (Shanghai Shenda Co. Ltd.)

- Auto Custom Carpets Inc.

- Autoneum Holding AG

- Borgers SE & Co. KGaA

- Conform Automotive

- Foss Performance Materials LLC (AstenJohnson Inc.)

- German Auto Tops Inc.

- Hyosung Corporation

- Suminoe Textile Co. Ltd.

- Toyota Boshoku Corporation

- Walser GmbH

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=5296&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: +1-631-791-1145