Running a business in California comes with many responsibilities, and one of the most important tasks is handling sales tax correctly. The California Sales Tax Calculator can be a useful tool to help you stay on top of your tax obligations. Whether you're self-employed, a freelancer, or running a small retail store, staying updated with sales tax is essential to avoid penalties and ensure smooth business operations. That’s where the California Sales Tax Calculator can offer support and clarity in a simple way.

Sales tax in California is a combination of a statewide base rate and local district taxes, which can vary depending on the city or county. The state base rate is currently 7.25%, but it’s common for businesses to charge higher rates due to additional district taxes. This means that the total sales tax rate can differ significantly from one area to another. If you’re doing business in Los Angeles, San Diego, or San Francisco, the total sales tax rate you need to charge might not be the same. That’s why using a sales tax calculator built for California helps you quickly determine the right amount to charge on each transaction.

Entrepreneurs and small business owners are often juggling many roles at once. From managing inventory to dealing with customers and suppliers, there’s little time left for manual tax calculations. A sales tax calculator designed for California conditions can take away the guesswork. You simply enter the product price, select the location, and the calculator gives you the exact amount of tax. This saves time and reduces the risk of human error, helping you stay compliant with California's tax regulations.

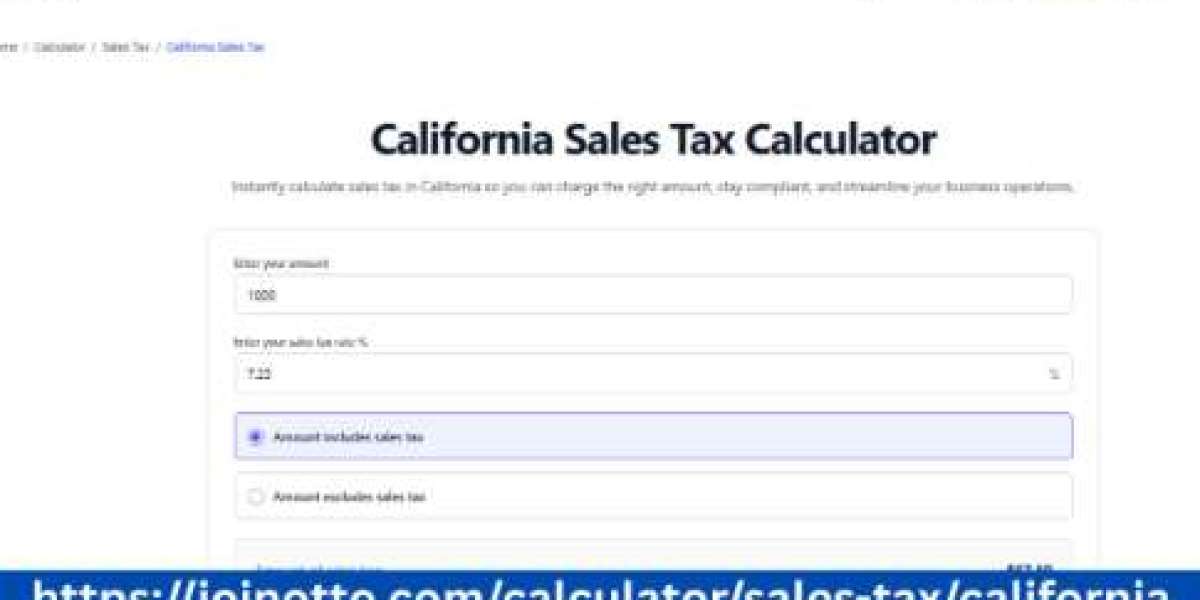

Otto AI understands the needs of local businesses and self-employed professionals. That’s why the California Sales Tax Calculator provided by Otto AI is built to be fast, accurate, and easy to use. You don’t need to be a finance expert to use it. It’s designed with simplicity in mind so anyone can get accurate tax results within seconds. You don’t even need to download anything—just visit the platform, plug in the numbers, and get your results instantly.

Many business owners also find themselves confused by the frequent updates in tax rates. Some cities and counties update their rates annually, and keeping track of these changes can be challenging. If you enter the wrong rate manually, it might lead to undercharging or overcharging customers. That’s where a California-specific sales tax calculator becomes even more helpful. It uses the latest tax data to make sure your figures are always up to date.

Let’s say you run a small bakery in San Jose. You want to make sure you’re charging the correct sales tax on each item sold. Instead of going through lengthy tax charts or government websites, you can use the sales tax calculator for California to instantly find the correct tax rate for your location. Enter the selling price, and the calculator will show both the sales tax amount and the final price after tax. This helps you in two ways—it gives your customers accurate receipts, and it ensures your business books remain correct.

Another benefit of using a sales tax calculator is its usefulness during tax filing. When it’s time to file your sales tax returns, you’ll need to report how much tax you collected. If you’ve been using a reliable calculator throughout the year, your records will already be accurate and easy to summarize. This can reduce the stress that comes with tax season, especially for solo entrepreneurs or small teams who handle accounting themselves.

Also, if you offer products both online and in-person, the tax rates might differ depending on where the customer is located. California’s sales tax rules can be tricky in this regard. Having a tool that accounts for those differences can prevent mistakes. You don’t want to overcharge a customer in a low-tax area or undercharge one in a high-tax zone. A dynamic calculator makes that job simpler by tailoring tax results based on location inputs.

Otto AI’s California Sales Tax Calculator also supports business growth by helping owners build trust with customers. When customers see fair and consistent pricing, they’re more likely to return and refer your business to others. Transparent pricing also improves customer satisfaction, and having reliable tax numbers on receipts adds a layer of professionalism to your brand.

If your business deals with hundreds of transactions daily, you already know that minor errors can add up. Using the right tool not only saves time but also improves overall business accuracy. The calculator can also be used to reverse-calculate tax—meaning if your price already includes tax, you can find out the original item cost and the tax portion separately. This is especially useful when setting prices or checking reports.

For example, if you want to sell an item for $50 in a city with a 9.25% tax rate, you can use the calculator to determine how much of that amount is tax. In a few seconds, you’ll see that approximately $4.23 is tax, and the base price is about $45.77. This allows you to keep your pricing strategy in control and make better business decisions.

The tool also helps service-based businesses. Many people assume sales tax only applies to physical products, but certain services in California are taxable too. If you’re in repair, installation, or digital services, you might need to collect tax on those services depending on local laws. A sales tax calculator for California helps you stay informed and reduces the chance of missing out on mandatory charges.

Whether you’re just starting your business journey or have been running it for years, staying updated with sales tax requirements is non-negotiable. Mistakes can lead to audits, fines, and loss of customer trust. With the Otto AI California Sales Tax Calculator, you get a reliable partner that takes care of the numbers while you focus on growing your business. It’s user-friendly, fast, and designed to meet California’s complex tax environment without adding to your workload.

In conclusion, the California Sales Tax Calculator is more than just a tool—it’s a necessity for businesses operating in one of the most tax-diverse states in the U.S. With Otto AI offering this service, local businesses and entrepreneurs have an advantage when it comes to staying compliant and efficient. From determining the right tax rate to generating quick, accurate results, this tool simplifies an essential part of your financial process. Try the California Sales Tax Calculator today and let Otto AI support your success, one transaction at a time.

Ask ChatGPT