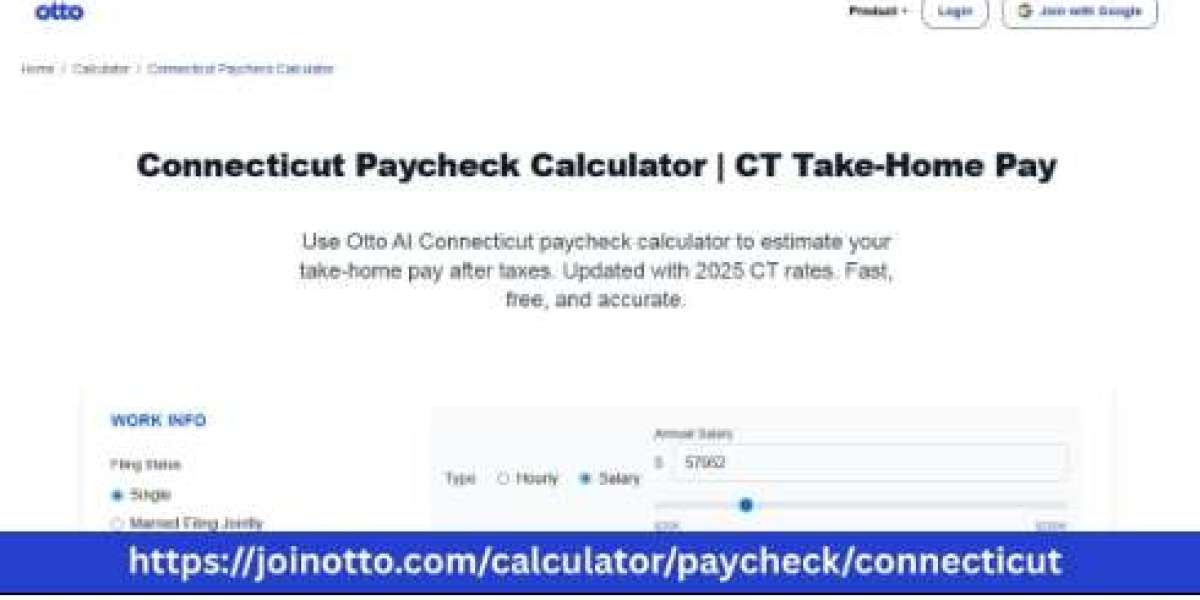

Handling payroll is one of the most important tasks for small business owners, freelancers, and entrepreneurs in Connecticut. Whether you are paying employees or calculating your own income, knowing how much will be left after taxes is essential. A Connecticut Paycheck Calculator helps you quickly estimate take-home pay by calculating deductions accurately. It saves you from the confusion of complex tax rules and ensures that payments are made correctly.

In this article, we will explain how a paycheck calculator works, what deductions are included, and how Otto AI can make payroll easy for you.

What is a Connecticut Paycheck Calculator?

A Connecticut Paycheck Calculator is an online tool that helps business owners and individuals figure out how much salary will remain after taxes and other deductions. It automatically calculates federal income tax, Connecticut state tax, Social Security, Medicare, and other deductions like health insurance or retirement contributions.

Instead of doing manual calculations or worrying about payroll errors, you can use this tool to get an accurate estimate of net pay in just a few seconds.

Why is Calculating Take Home Pay in Connecticut Important?

If you own a business or work for yourself, knowing how to calculate take home pay in Connecticut is crucial. It helps you manage your business finances, ensure correct tax payments, and maintain employee trust. Mistakes in payroll can lead to penalties, employee dissatisfaction, and financial mismanagement.

A paycheck calculator Connecticut ensures that you are making correct deductions and paying your employees accurately. It also helps self-employed professionals understand how much they will earn after taxes are taken out.

Types of Deductions Included in Connecticut Paychecks

When using a Connecticut Paycheck Calculator, it’s important to understand the deductions that affect the final paycheck:

Federal Income Tax – This tax is based on IRS tax tables and depends on income level and filing status.

Connecticut State Income Tax – The state tax rate varies from 3% to 6.99% depending on how much you earn.

Social Security and Medicare Taxes – These are payroll taxes shared between employer and employee.

Pre-tax Deductions – Contributions like health insurance premiums or retirement plans that reduce taxable income.

Post-tax Deductions – Other deductions such as wage garnishments or union dues applied after taxes.

A Connecticut Paycheck Calculator takes all these factors into account automatically.

How to Use a Paycheck Calculator Connecticut?

Using a paycheck calculator Connecticut is simple and does not require accounting knowledge. Follow these steps:

Enter the employee’s gross pay before any deductions.

Select the payment frequency (weekly, bi-weekly, monthly).

Choose the correct filing status (single, married, head of household).

Input any pre-tax deductions like health insurance or 401(k) contributions.

Add any post-tax deductions if applicable.

Click calculate to see the estimated take-home pay.

Otto AI’s Connecticut Paycheck Calculator is designed to be easy-to-use, giving quick and precise results tailored for small businesses and entrepreneurs.

Connecticut State Tax Rates You Should Know

Connecticut follows a progressive income tax system, which means the tax rate increases with higher income. Here’s a basic breakdown:

Income up to $10,000 is taxed at 3%

Income from $10,001 to $50,000 is taxed at 5%

Income above $50,000 is taxed at 6.99%

Higher earners may also face a phase-out of certain tax credits, which increases the overall tax burden. A paycheck calculator adjusts these rates for you automatically, so you don’t need to worry about manual calculations.

Benefits of Using a Connecticut Paycheck Calculator

For business owners and freelancers, using a paycheck calculator Connecticut offers several advantages:

Accuracy: You get precise calculations every time, avoiding manual mistakes.

Time-Saving: Payroll becomes a quick task that takes just minutes.

Compliance: Ensures all tax laws and deductions are correctly applied.

Financial Clarity: Helps you understand how much payroll costs your business.

Employee Trust: Transparent paycheck breakdown builds better relations with employees.

Otto AI provides a Connecticut Paycheck Calculator that is designed with the needs of small businesses in mind, making payroll processing easy and stress-free.

Common Mistakes to Avoid in Payroll Calculations

Even with a calculator, errors can happen if the wrong data is entered. Here are common mistakes you should avoid:

Choosing the wrong pay frequency.

Entering incorrect filing status.

Forgetting to include pre-tax deductions like health insurance.

Missing out on post-tax deductions.

Using outdated tax rates.

Otto AI updates its Connecticut Paycheck Calculator regularly to ensure that tax rates and deductions are always accurate.

Tips for Small Business Owners to Manage Payroll Efficiently

Managing payroll can become easy if you follow these simple tips:

Stay updated with Connecticut tax laws.

Automate payroll using tools like Otto AI.

Maintain clear records of all payments and deductions.

Explain pay stubs to employees for better transparency.

Consult professionals for complex payroll situations.

Why Self-Employed Individuals Need a Paycheck Calculator

Self-employed professionals are responsible for managing both employer and employee portions of taxes. Without a paycheck calculator Connecticut, it becomes difficult to figure out how much income you’ll actually have after paying taxes and deductions.

By using a paycheck calculator, you can plan your finances better, prepare for quarterly tax payments, and avoid any end-of-year tax surprises.

Conclusion

Handling payroll in Connecticut doesn’t have to be stressful or complicated. A Connecticut Paycheck Calculator is a simple and effective tool that helps small business owners, entrepreneurs, and self-employed individuals calculate take-home pay accurately. It ensures you stay compliant with tax laws, avoid payroll mistakes, and maintain transparency with employees.

Otto AI offers an easy-to-use Connecticut Paycheck Calculator designed specifically for businesses and freelancers. By using the right tools, you can save time, reduce errors, and focus on growing your business with confidence.