Navigating the ins and outs of sales tax can often feel like a challenge, especially in Connecticut where the sales tax rate is typically 6.35%, but exceptions and special rates exist. Whether you're a shopper trying to understand the full price of an item or a business owner ensuring you're compliant with state tax regulations, having a reliable tool at your disposal is essential. That’s where the Connecticut Sales Tax Calculator comes in.

This tool takes the confusion out of tax calculations by automatically applying the correct tax rates, accounting for exemptions, and providing you with a quick and accurate result. Whether you’re buying a shirt, selling electronics, or running a small business, understanding how to use the Connecticut Sales Tax Calculator can save you time and help you avoid costly mistakes. In this post, we’ll break down how it works and why you should be using it.

What is the Connecticut Sales Tax Calculator?

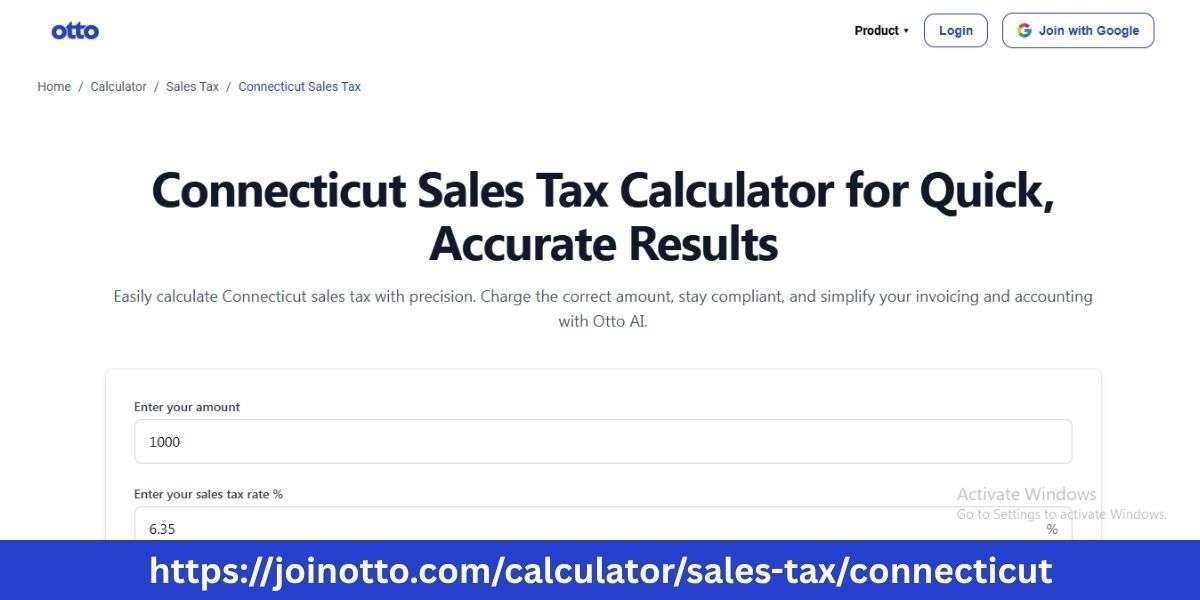

A Connecticut Sales Tax Calculator is a tool designed to quickly calculate the amount of sales tax due on a transaction based on the price of goods or services. By entering the price of the product you're buying or selling, the calculator will apply Connecticut's 6.35% sales tax (or other applicable rates) to determine how much tax you owe or need to collect.

This calculator is especially useful because Connecticut has several exemptions, like for food and clothing items, which can complicate manual calculations. It ensures that businesses and consumers alike pay the right amount of sales tax, making the process simpler and more efficient.

How Does the Connecticut Sales Tax Calculator Work?

Using a Connecticut Sales Tax Calculator is simple and fast. Here’s a step-by-step guide to how it works:

Enter the Item's Pre-Tax Price: You start by inputting the price of the product or service before tax. This is the base price.

Apply the Sales Tax Rate: The calculator will automatically apply the appropriate sales tax rate, which in most cases is 6.35%. However, if the item qualifies for an exemption or reduced rate, the calculator will adjust accordingly.

Tax Calculation: The calculator will multiply the base price by the tax rate. For example, if you’re purchasing a product worth $200, the sales tax would be $12.70 ($200 × 6.35%).

Total Cost After Tax: The calculator will then add the tax to the base price to give you the total cost. For instance, the final price for a $200 item with a $12.70 tax would be $212.70.

This simple process helps both consumers and businesses quickly determine the total price and ensures accuracy in the calculation.

Why Should You Use the Connecticut Sales Tax Calculator?

There are many reasons why the Connecticut Sales Tax Calculator is so helpful for both consumers and businesses:

Accuracy: Sales tax can be tricky, especially with exemptions and varying rates for different types of products. A calculator ensures that you’re always applying the correct tax rate.

Convenience: Instead of manually calculating the sales tax for each product or transaction, the calculator instantly gives you the correct amount. This saves time and reduces the risk of mistakes.

Helps with Budgeting: For consumers, knowing exactly how much sales tax will be added helps you better plan your budget before making a purchase.

Business Compliance: For businesses, it’s crucial to collect the right amount of tax. By using a calculator, you ensure that you’re following Connecticut's sales tax laws and avoid potential fines or penalties for miscalculating.

Handles Exemptions: Connecticut offers several exemptions, like for food, clothing, and prescription drugs. A calculator automatically adjusts for these exemptions, ensuring that you're not charged sales tax on items that are exempt.

Common Sales Tax Exemptions in Connecticut

Connecticut’s sales tax laws provide several exemptions and exceptions that can be confusing for both shoppers and businesses. Here are some of the most common ones:

Clothing and Footwear: Most clothing and footwear priced under $50 per item are exempt from sales tax. For example, if you purchase a sweater for $40, no sales tax will be applied. However, if the sweater costs more than $50, sales tax will be charged.

Food for Home Consumption: Most grocery items are exempt from sales tax in Connecticut. However, prepared foods (like meals at restaurants or deli sandwiches) are subject to sales tax.

Prescription Drugs: Prescription drugs, both for humans and animals, are exempt from sales tax in Connecticut.

Certain Services: Professional services, such as legal or medical services, are generally not subject to sales tax. However, services related to tangible property (like repairs or cleaning) are taxable.

Digital Goods: Some digital products, such as e-books or downloadable music, are taxable. However, some digital services (such as streaming services) may not be.

A Connecticut Sales Tax Calculator automatically accounts for these exemptions, so you don’t have to worry about making mistakes.

How Businesses Benefit from the Connecticut Sales Tax Calculator

For business owners in Connecticut, ensuring the correct sales tax is charged is crucial for compliance with state law. A Connecticut Sales Tax Calculator provides the following benefits for businesses:

Accurate Tax Collection: Businesses are required to collect the correct amount of sales tax from their customers. A calculator ensures you’re charging the right amount based on the current tax rate.

Simplified Tax Reporting: Businesses need to report the total amount of sales tax collected on a regular basis. Using a calculator allows for accurate and straightforward tracking of sales tax over time.

Avoiding Penalties: Incorrectly charging sales tax can result in penalties from the state. By using a calculator, businesses reduce the risk of errors and ensure they stay compliant with tax laws.

Handling Exemptions: If your business sells exempt items (such as clothing under $50 or prescription drugs), the calculator ensures that these products are not taxed incorrectly.

Time Efficiency: Instead of manually calculating tax for every item or transaction, businesses can use the calculator to quickly determine the correct amount of tax, freeing up time to focus on other aspects of the business.

Tips for Using the Connecticut Sales Tax Calculator

Here are a few tips to make sure you're getting the most out of the Connecticut Sales Tax Calculator:

Enter the Correct Price: Always input the price of the item before any discounts or promotions. If you have a coupon, apply it first, and then input the discounted price into the calculator.

Check for Exemptions: Be familiar with which products are exempt from sales tax, so you can ensure the calculator is applying the right tax rate.

Use for Multiple Items: Many calculators allow you to input multiple items. This feature is especially helpful for business owners who need to calculate tax for an entire order or sale.

Verify Results: After using the calculator, double-check the total to ensure it aligns with what you expect. This extra step helps ensure that there are no mistakes, especially for larger purchases.

Stay Updated: Sales tax rates and exemptions can change over time. Make sure the calculator you're using is updated to reflect any changes in Connecticut’s tax laws.

How to Choose the Best Connecticut Sales Tax Calculator

Not all Connecticut Sales Tax Calculators are the same. Here’s what to look for when selecting one:

Accuracy and Updates: Choose a calculator that reflects the most up-to-date sales tax rate and exemptions in Connecticut.

Ease of Use: The calculator should be easy to use, with clear input fields and simple instructions. It should provide quick and accurate results.

Customization: If you’re a business owner, look for a calculator that can handle multiple items and automatically apply exemptions.

Mobile-Friendly: A calculator that works well on mobile devices is a great option for those who need to calculate sales tax while on the go.

Conclusion

A Connecticut Sales Tax Calculator is an essential tool for anyone making or managing purchases in the state. It helps ensure that the right amount of sales tax is charged, whether you’re a consumer trying to figure out the total cost of your shopping or a business owner ensuring compliance with state tax laws. By using a sales tax calculator, you can save time, avoid mistakes, and have peace of mind knowing that your tax calculations are accurate and up-to-date.

Understanding and using the Connecticut Sales Tax Calculator is a simple step that can make a significant difference in your shopping experience or business operations.